Data Entry

Add Business/Organization

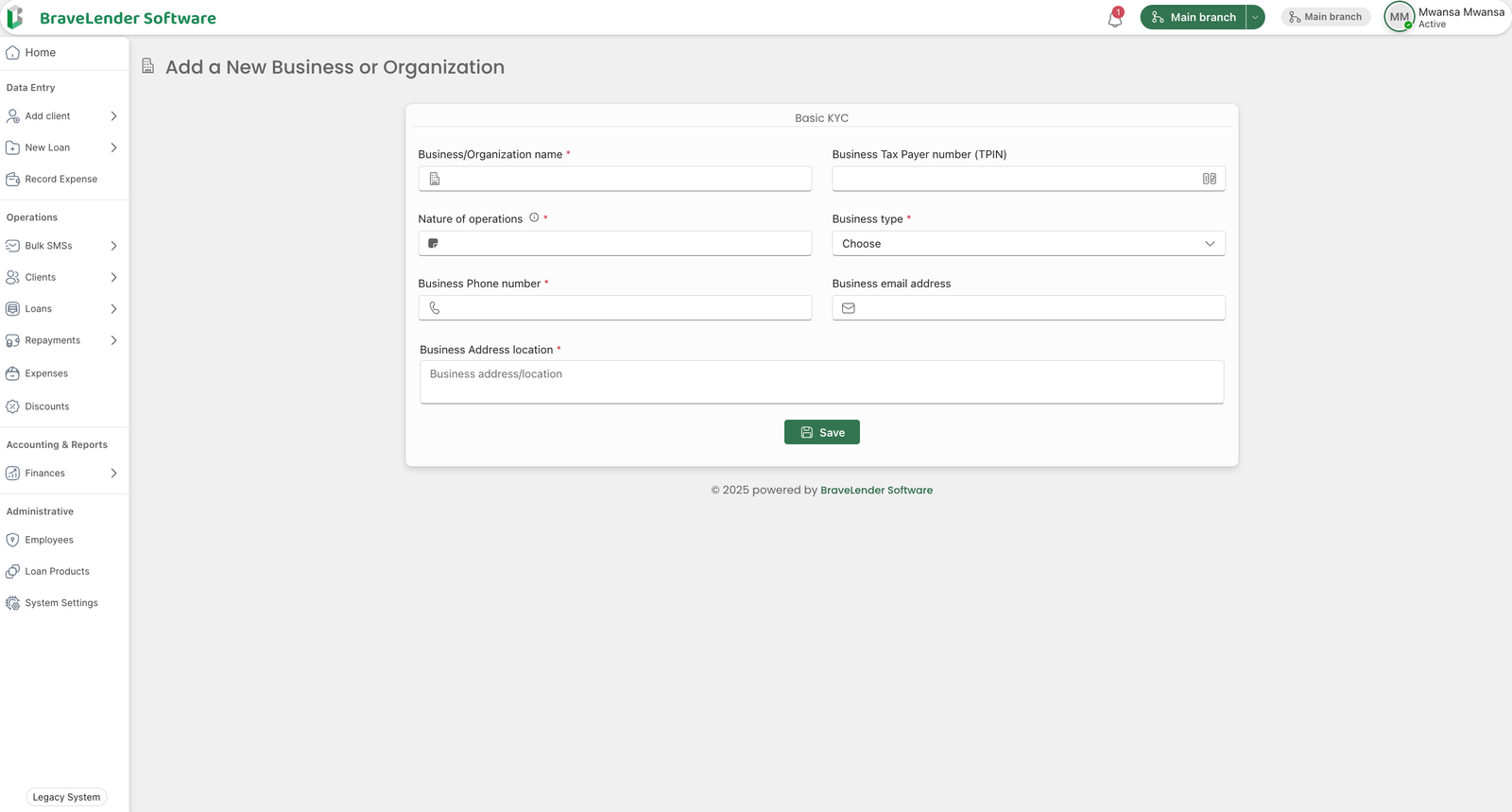

#Overview

This document outlines the process for adding a business or organization as a borrower, including the required Know Your Customer (KYC) information.

#Required KYC Information

To add a business or organization as a borrower, the following details must be provided:

- Business/Organization Name - The registered name of the business or organization.

- Business Taxpayer Number (TPIN) - A valid taxpayer identification number.

- Nature of Operations - A description of the business activities.

- Business Type - The classification of the business (e.g., Sole Proprietorship, Partnership, Limited Company, NGO, etc.).

- Phone Number - A valid business contact number.

- Email Address - The official email address of the business.

- Address Location - The physical or registered business address.

#Steps to Add a Business or Organization Borrower

#Step 1: Log in to the BraveLender

- Log in to the BraveLender using your credentials.

- Navigate to the "Add Client" section under "Data Entry".

- Click on the "Business/Organization" button.

#Step 2: Enter Business KYC Information

- Fill in the required details:

- Business/Organization Name

- Business Taxpayer Number (TPIN)

- Nature of Operations

- Business Type

- Phone Number

- Email Address

- Address Location

#Step 3: Validate Information

- Ensure that:

- The business name is unique and correctly spelled.

- The Business Taxpayer Number (TPIN) is valid.

- The nature of operations is well-defined.

- The business type is correctly selected.

- The phone number and email address are in the correct format.

- The address location is complete and accurate.

#Step 4: Submit Business Information

- Click on the "Submit" or "Save" button.

- The system will validate and store the business details.

- If there are errors, correct them based on the validation messages and resubmit.

#Step 5: Confirmation and Record Storage

- Once successfully added, the business borrower will be recorded in the system.

- A confirmation message will be displayed.

- Optionally, notify the business via email or SMS about the registration.

#Notes

- Ensure the Business Taxpayer Number (TPIN) is accurate to comply with tax and financial regulations.

- Maintain confidentiality and security of business data.

- Businesses may be required to provide additional supporting documents based on lending policies.

#Conclusion

Following these steps ensures the proper registration of a business or organization as a borrower, enabling efficient loan processing and compliance with financial regulations.