Data Entry

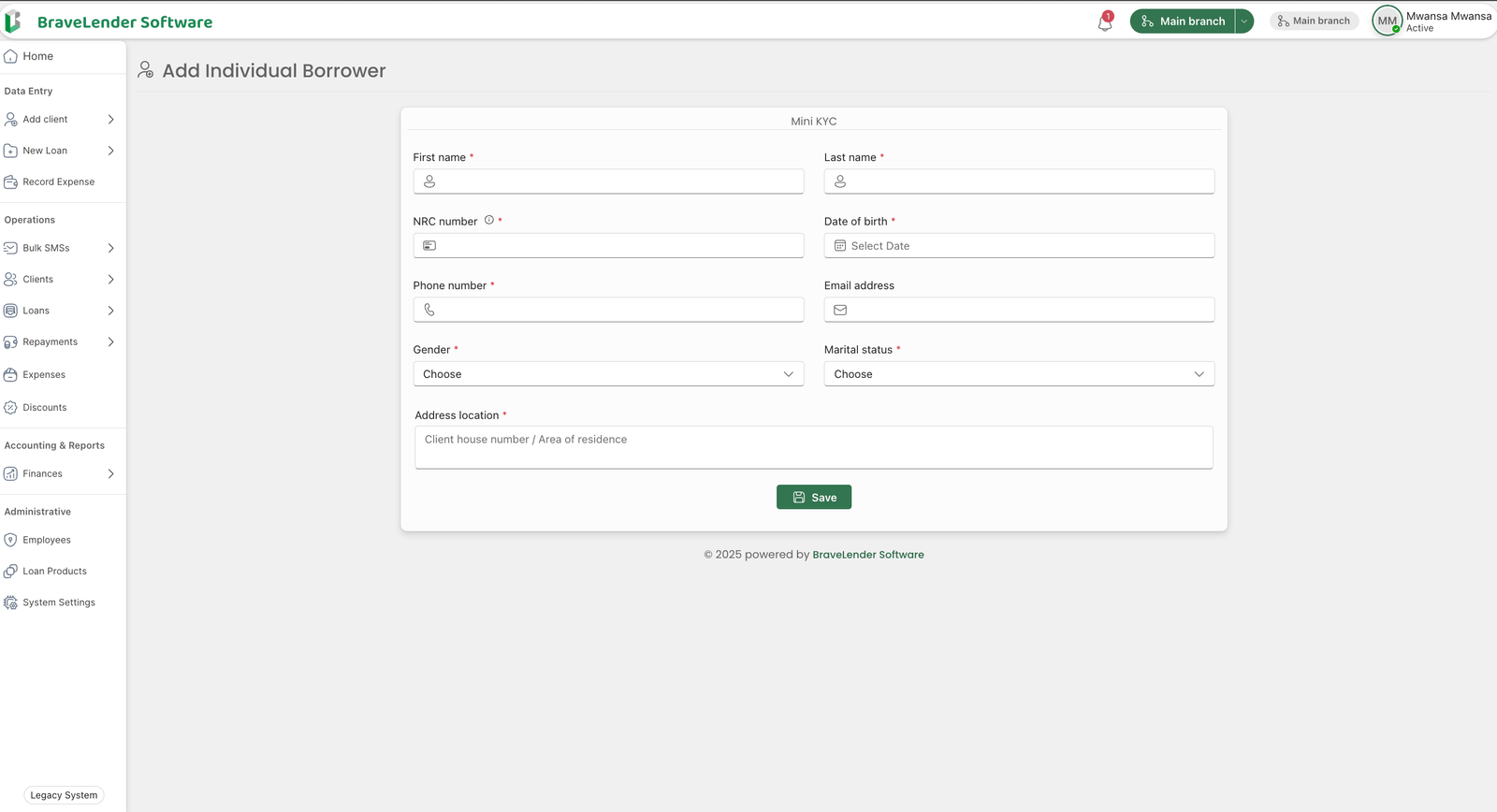

Add Individual Borrower

#Overview

This section outlines the process for adding a client borrower, including the required Know Your Customer (KYC) information. A client can be an individual, a group or business/organization.

#Required KYC Information

To add an individual borrower, the following details must be collected:

- First Name - Borrower’s given name.

- Last Name - Borrower’s surname.

- Email - A valid email address.

- NRC Number - National Registration Card number for identity verification.

- Date of Birth (DOB) - Borrower’s birth date in YYYY-MM-DD format.

- Phone Number - A valid phone number.

- Gender - Male, Female, or Other.

- Marital Status - Single, Married, Divorced, or Widowed.

- Address - Residential address.

#Steps to Add an Individual Borrower

#Step 1: Access the Borrower Management System

- Log in to the BraveLender using your credentials.

- Navigate to the "Add Client" section under "Data Entry".

- Click on the "Individual Borrower" button.

#Step 2: Fill in KYC Information

- Enter the required details in the respective fields:

- First Name

- Last Name

- NRC Number

- Date of Birth

- Phone Number

- Gender

- Marital Status

- Address

#Step 3: Validate Information

- Ensure that:

- The NRC Number matches the correct format.

- The email is in a valid format.

- The phone number follows the correct format.

- The date of birth is correctly entered.

- The required fields are not left blank.

#Step 4: Submit the Borrower Information

- Click on the "Submit" or "Save" button.

- The system will validate and save the borrower’s details.

- If any errors occur, correct them as per the validation messages and resubmit.

#Step 5: Confirmation and Record Storage

- Once successfully added, the borrower’s profile will be stored in the system.

- A confirmation message will be displayed.

- Optionally, notify the borrower via email or SMS regarding their registration.

#Notes

- Ensure data accuracy to comply with regulatory KYC requirements.

- Maintain borrower confidentiality and handle personal data securely.

- Regularly update borrower details if there are any changes.

#Conclusion

By following these steps, an individual borrower can be successfully added to the system, ensuring compliance with KYC regulations and efficient borrower management.