Data Entry

Add Group

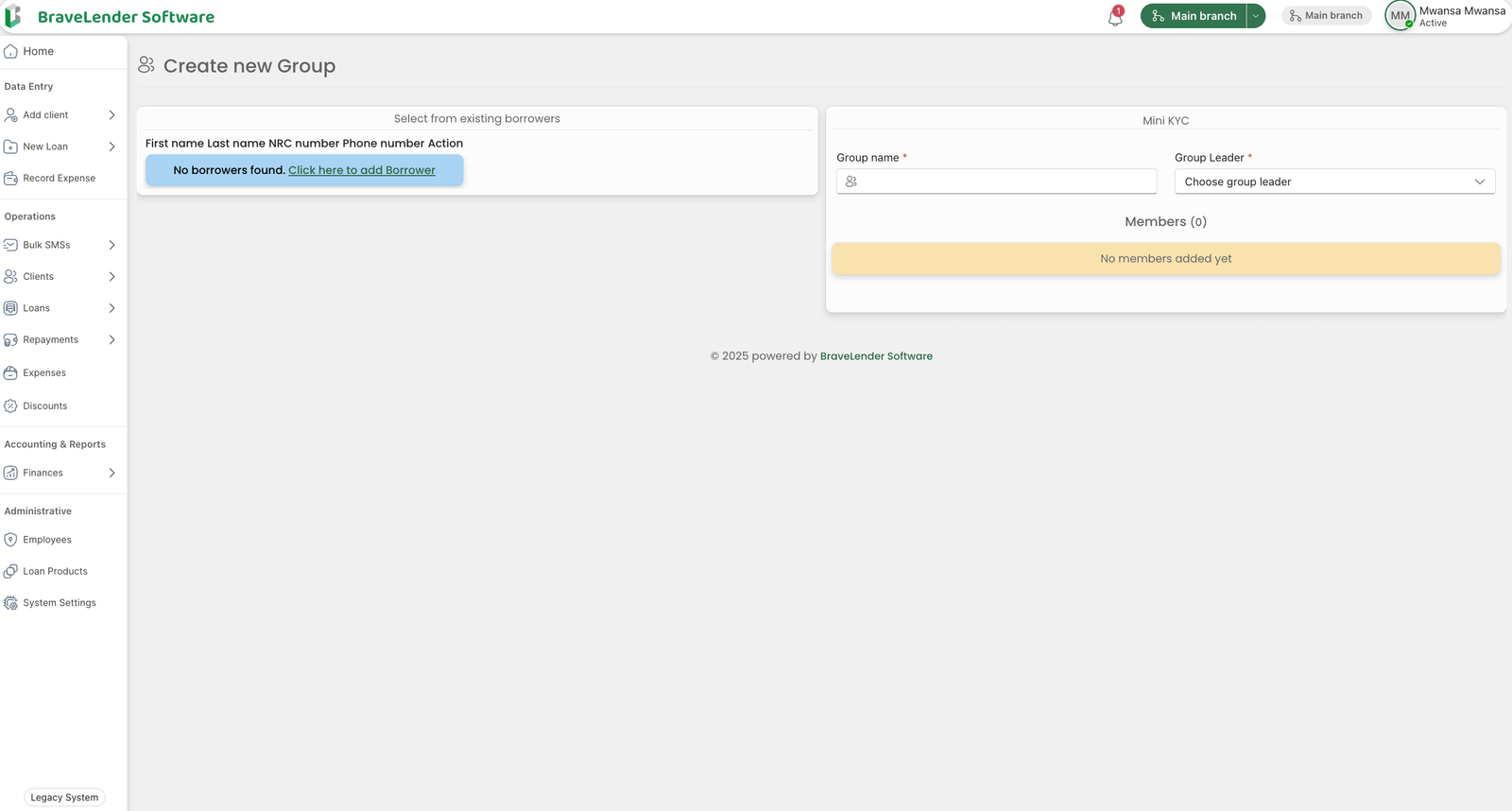

#Overview

This document provides guidelines for adding a borrower group, including the required Know Your Customer (KYC) information and the steps to complete the process.

#Required KYC Information

To create a borrower group, the following details must be collected:

- Group Name - A unique name for the borrower group.

- Group Leader - A designated leader chosen from existing individual borrowers.

- Group Members - A list of members added from the existing borrower records.

#Steps to Add a Borrower Group

#Step 1: Access the Borrower Management System

- Log in to the borrower management system using your credentials.

- Navigate to the "Borrower Groups" section.

- Click on the "Add New Group" button.

#Step 2: Enter Group Information

- Fill in the required group details:

- Group Name: Provide a unique name for the group.

- Group Leader: Select an existing borrower to serve as the leader.

- Group Members: Add members by selecting from the list of existing borrowers.

#Step 3: Validate Group Information

- Ensure that:

- The group name is unique.

- The group leader is a valid existing borrower.

- Group members are selected from registered borrowers.

- The group meets the minimum required number of members (if applicable).

#Step 4: Submit the Group Information

- Click on the "Submit" or "Save" button.

- The system will validate and store the group details.

- If errors occur, correct them based on the validation messages and resubmit.

#Step 5: Confirmation and Record Storage

- Once successfully added, the borrower group will be recorded in the system.

- A confirmation message will be displayed.

- Optionally, notify the group leader and members about the group registration.

#Notes

- Ensure all group members are properly registered individual borrowers.

- Maintain accurate records for loan management and compliance.

- The group leader is responsible for coordinating group activities and communications.

#Conclusion

Following these steps ensures the proper registration of a borrower group, streamlining group-based lending and management within the system.